Do you want to get a copy of a free PPSR report? If yes, Please click here

The free PPSR report which we provide free of cost, will have general information listed on it. It may not include the comprehensive report of the personal property or the motor vehicle. You must seek professional advice and make your own independent enquiries before making any decision to purchase any asset.

Purchasing a motor vehicle from a private seller

You should be very careful when purchasing an asset from a private seller if you don’t want to put any finance on it. We make the process very simple for you if you ever purchase any asset from a private vendor throughout your life, which we believe you will

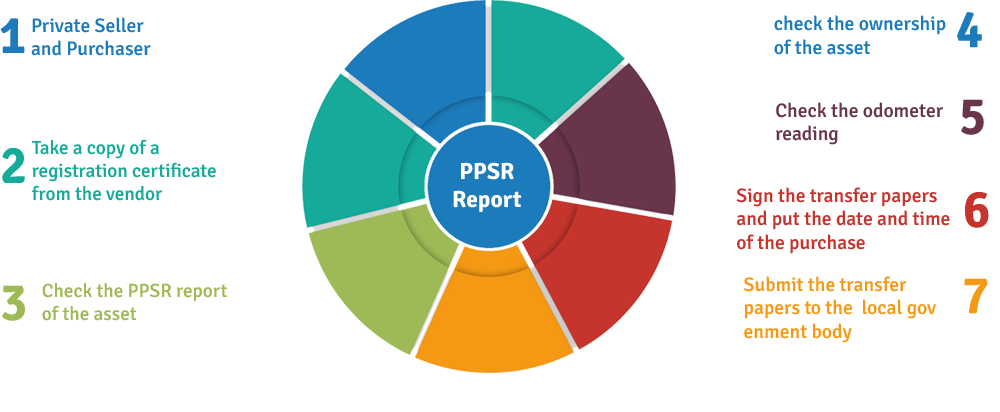

There are few steps you must follow apart from the mechanical inspection to secure your money if you have decided to purchase a car from a private seller and if you are not going to take out any finance.

If you are going to buying a motor vehicle for Personal Use

Ask the vendor if there is any finance on the vehicle. If the vendor is saying that the asset has finance on it, then ask for the payout quote from the financier and make the payment listed on the payout figure directly to the financier and the difference to the vendor when you finalise the purchase.

We can help you to get the free PPSR report if you are not sure how to get it. To access the free report please click here. If there is nothing listed on the PPSR report, then you can move to the next step. But if you find something like the vehicle is stolen or any financier or third-party interest, you must hold onto your money and discuss with the vendor. We strongly recommend you have a discussion with a professional or legal advice before you take any further steps.

Ask the vendor to give you a copy of a driver’s license, which you must match with the registration certificate if the vehicle is registered under his personal name. If you are buying an asset from a person, for example, you are buying a motor vehicle from Jag, my license details must match with the registration certificate. However, if you are buying a motor vehicle from a company in which the person who is selling the asset is the director, then you must ask the person to prove that he or she is the director or the authorised person of the company, or you can do a company search where you can find the information of the directors. We can also help you to guide you through if you need any further assistance.

If it is an old car and it has low kilometres, we highly recommend you check the comprehensive report of the asset that shows the odometer reading as well. We have seen in some cases where the odometer had been rolled back, and the customer has lost a lot of money as a result.

You must have a copy of motor vehicle transfer papers which needs to be signed by both parties. We highly recommend you take a witness with you to confirm the signatures of both parties as well.

You are happy with the searches and from the professional advice if taken any, then you can finalised your purchase.

Make sure you are putting the date and time to the transfer paper before taking the keys from the vendor. Just to cover your back, if the vendor has ran any red lights or had been issued with any fines on the day of the purchase then you can transfer it back to their name by keeping that record on the transfer papers.

Most lenders are directing their interest to the personal property (assets or equipment etc.) through the personal property securities register. This register keeps the data of all the interested parties who have put their interest onto a personal property. When you are purchasing any asset that includes but is not limited to trucks, trailer etc. from a private vendor, you must make sure that you are checking the PPSR before making any payment. To find out more and get a copy of a free PPSR report please click here.

If you are going to buy a motor vehicle for a business purpose

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

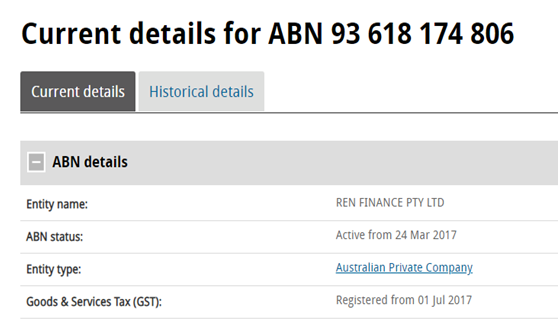

If you are buying a motor vehicle from a sole trader, company or from any business entity, you must get a tax invoice, and on the tax invoice you must check the ABN through the ABN look up. If the vendor is charging you GST on the tax invoice, then the ABN of the Vendor must be registered for GST. For example, if you are buying an asset from Ren Finance pty Ltd and the given ABN on the tax invoice is 93 618 174 806, you must check the ABN is GST registered through the ABN look up https://abr.business.gov.au/

If the given ABN on the tax invoice is not registered for GST, Ren Finance Pty Ltd shouldn’t be including GST on the tax invoice, so be very careful here. Please note: provided information is a guide only and this is not professional advice, we highly recommend speaking to a professional or an accountant before making any decision to purchase the asset. Click here for disclaimer.